The Nation’s Leanest Market

Portland has the Lowest Supply-to-Absorption Ratio in the U.S.

Demand Continues Outpacing Supply

Portland Population Rebound Signals Opportunity

The Portland metro area is experiencing a demographic revival. According to Oxford Economics, the Portland Metropolitan Statistical Area (MSA) population reached 2,537,450 by Q4 2024, reflecting steady growth. Even more telling, net migration swung positive with 4,850 new residents in the final quarter alone—a sharp turnaround from the declines seen in 2023. This influx, bolstered by Multnomah County’s net gain of 1,600 residents for the year (a +10,600 shift from the prior year’s loss), underscores a renewed appeal for the region.

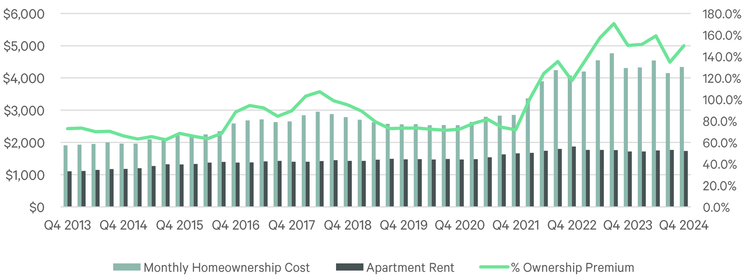

Affordability Gap Drives Renters

Portland’s Housing Opportunity Index (HOI), a measure of homebuyer affordability, is a slim 18.3%. This reflects the percentage of homes sold in the Portland metro area that a family earning the median income can afford—far below the national average of 38% and lagging behind cities like Denver, Seattle, Phoenix, Dallas, Orlando, Tampa, Chicago, and Austin.

Only Las Vegas, New York, Miami, San Jose, San Francisco, San Diego, and Los Angeles rank lower. This affordability crunch keeps renters in place longer, intensifying pressure on an already strained rental supply.

Housing Opportunity Index (%)

Source: JLL Research, Real Capital Analytics

Monthly Rent vs. Monthly Homeownership Costs

Source: CBRE Research, CBRE Econometric Advisors, Q4 2024

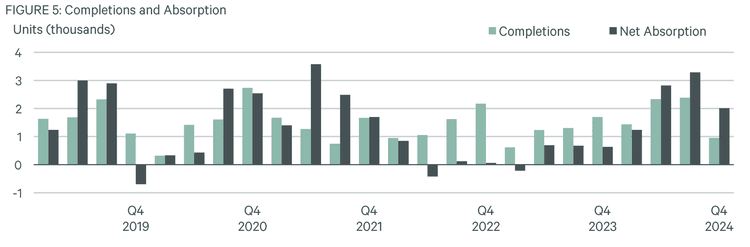

Construction Lags, Supply Pressure Intensifies

To make matters worse - since 2022, Portland has seen a staggering 98% decrease in construction starts—outranked only by Austin, San Diego, and San Jose among major U.S. cities. Construction starts dropped to 4,375 units in Q4 2024, far below the 10-year average of 10,374. Looking ahead, only ~3,000 units are slated for delivery between 2025 and 2026—the weakest pipeline since 2012–2013.

Meanwhile, renter demand shows no signs of slowing: nine straight quarters of 750+ units absorbed, with over 6,000 units leased in the trailing 12 months.

A National Standout: Lowest Supply-to-Absorption Ratio

And the proof is in the pudding - Portland has the lowest 5-year supply-to-absorption ratio in the U.S. among markets with at least 60,000 apartment units, per CBRE’s Brennan Franssen. This metric tracks available units (supply) against those leased by renters (demand) over five years. A rock-bottom ratio means apartments are being snapped up faster than they’re built or vacated—faster than anywhere else in the nation among comparable markets.

Source: CBRE Research, CBRE Econometric Advisors, Q4 2024

Capital Markets: Competition to Finance

A “Risk-On” Mindset Prevails

The optimism from late 2024’s credit markets has carried into 2025, with lenders embracing a risk-on approach. Near-historic low credit spreads and increasingly aggressive terms signal strong appetite for financing across asset classes. Big deals are back: Insurance companies, banks, and debt funds are quoting $100M+ transactions, and the SASB pipeline is nearing record highs.

Capital Chasing Deals

All lender types are active and eager to deploy capital—many targeting 1.5–2X their 2024 production. Living, industrial, retail, and select alternative assets remain hot, but lenders are increasingly open to other property types to hit their goals. Simply put, there’s more debt capital than deals to finance. This imbalance is driving credit spreads to tighten as competition heats up—a boon for developers ready to break ground.

Across CMBS, debt funds, government agencies, insurance companies, banks, and private capital, no single lender type is financing more than 25% of commercial volume, reflecting a diverse and competitive lending landscape.