INVESTMENT STRATEGY

ACQUIRE

DESIGN

OPERATE

DEVELOP

Our strategy centers on the acquisition and development of high-quality infill sites in walkable, amenity-rich neighborhoods in Portland, OR. We target locations with convenient access to education, dining, entertainment, retail, and public transit.

We focus on midrise multifamily buildings in sub-markets where market-rate rents naturally align with local affordable housing thresholds, enabling us to deliver well-integrated housing that meets both community needs and financial sustainability.

-

$20,000,000 - $60,000,000

-

25%+

-

2.5xx +

-

36+ Months

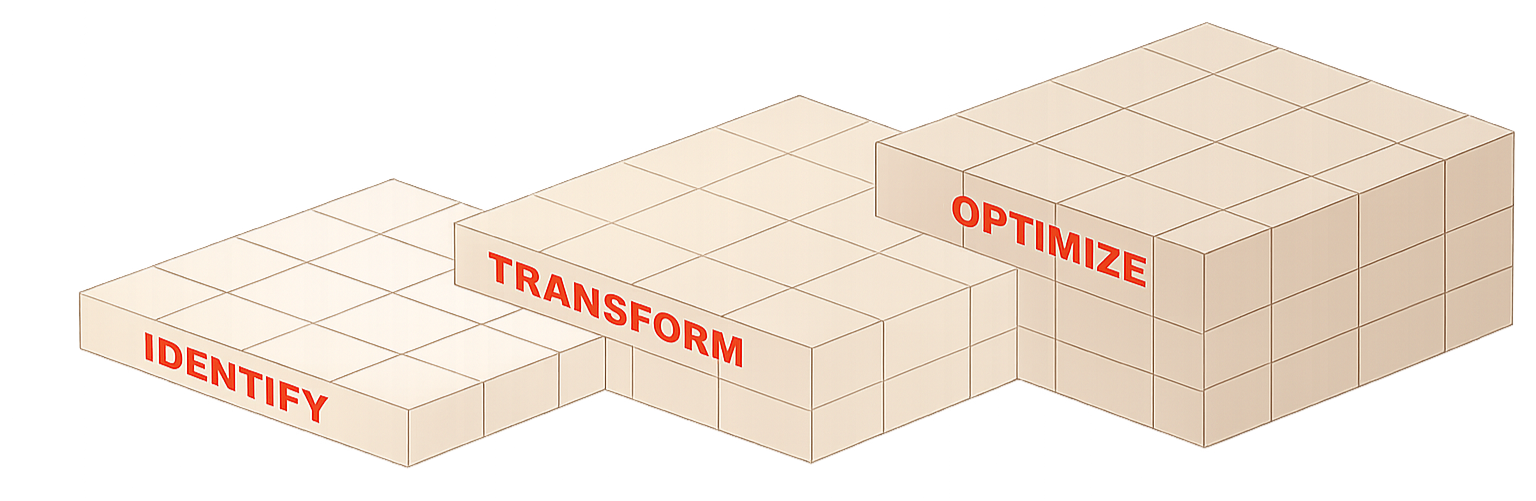

A Process for Compounding Value

We add deep domain expertise where it matters throughout the life-cycle of an investment, in an effort to create compounding value and drive excess returns.

IDENTIFY

We leverage demographic and psychographic analysis to identify walkable, amenity-rich sites—locations surrounded by acclaimed dining, retail, and cultural anchors—where lifestyle and zoning support durable demand.

OPTIMIZE

We optimize investment performance through a fully integrated platform. We maintain control from concept to operations — driving cost efficiency, execution certainty, and long-term asset performance.

TRANSFORM

We translate renter needs and lifestyle preferences into thoughtful design, transforming sites into high-quality residences that enhance livability, accelerate lease-up, and drive long-term value.

=

Compounding Alpha

With an ROI-driven mindset and a holistic view of the investment lifecycle, we apply disciplined decision-making to deliver best-in-class assets that meet unmet housing demand while generating attractive, risk-adjusted returns.

With dedicated in-house divisions for development, construction and property management, Seneca controls the full lifecycle of every asset—from pre-development through long-term operations.

WHERE WE INVEST

Our unparalleled depth of industry experience allows us to assemble and analyze the best market data.

This positions us to identify the strongest investment opportunities and execute a comprehensive plan that delivers lasting quality for residents, clients, and partners.

OUR CRITERIA

Site Profile

Seneca prioritizes infill sites that align with our development model and return profile. Target properties support 75–300 unit midrise projects. We focus on parcels with strong fundamentals—proximity to transit, resilient demand drivers, and zoning frameworks that support efficient, repeatable building types—ensuring each site positions the project for smooth execution and durable long-term value.

Rent Affordability

Our strategy emphasizes “naturally affordable” housing—market-rate units that fall within 60%–100% of Area Median Income. By targeting this rent band, we maintain regulatory alignment, broaden renter accessibility where demand is most acute, and create conditions for faster lease-up, stronger tenant retention, and more resilient long-term performance.

Underwriting

Each project is underwritten to meet institutional standards for yield-on-cost and stabilized returns. We maintain disciplined control over land and construction basis, and we stress test rents, lease-up timing, interest rates, and cost escalation to ensure durability, resilience, and downside protection under all conditions.

Low Friction

Each project must demonstrate a clear, low-friction path from acquisition to stabilization. We prioritize business plans with minimal entitlement exposure, predictable construction scope, and rapid lease-up potential. We eliminate discretionary risk, simplify operations, and ensure the product has a deep, proven renter base—allowing us to accelerate value creation and protect downside.

Why Real Estate Development?

For decades, most individual investors accessed real estate exposure through public REITs or passive income funds. Yet, private multifamily development has consistently offered a more compelling risk–return profile—particularly for those positioned early in the value creation cycle. Unlike stabilized assets, development projects generate return not just from income, but from execution alpha: entitlement, design, construction efficiency, and timing the lease-up to market demand.

These projects also bring meaningful portfolio diversification benefits. Ground-up multifamily development is largely uncorrelated to equities, bonds, and even public REITs, as returns are driven by local supply-demand fundamentals, cost control, and project execution, not daily market sentiment.

Diversifying with Real Estate

Historical Correlations Highlight Private Real Estate’s Diversification Benefits (2005–2024)

Where You Invest Matters

In real estate development, focus creates edge. Seneca concentrates exclusively on multifamily development in the Portland, Oregon metro, where long-term demand, geographic constraints, and progressive land-use policy create enduring fundamentals for new housing supply.

Rather than chase short-term migration trends or volatile growth markets, Seneca invests where stability, scarcity, and livability intersect. Portland’s combination of limited buildable land, growing employment sectors, and persistent housing undersupply continues to support rent durability and long-term absorption — even as other U.S. metros experience softening from overdevelopment.

Considerations Before Allocating Capital

Investing in private multifamily development means committing capital to create tangible assets that rely on expertise, disciplined execution, and local insight — not market liquidity — to realize their full value.

Success in this arena is defined by sponsor capability — the ability to source land intelligently, secure entitlements efficiently, manage construction risk, and deliver stabilized assets that align with long-term housing demand. Key differentiators include local scale, cost control, and a proven track record of execution within a defined market.

Education and alignment are equally important. Investors should understand the full development lifecycle—from land acquisition through lease-up—and the drivers of return at each stage. The right partner is one who operates with transparency, discipline, and focus, broadening investor understanding of how private development fits within a long-term wealth strategy.

With the right partner, investors gain exposure not just to an asset class, but to the process of value creation itself—a stage of the market where risk is matched by control, and where expertise, not market timing, defines outcomes.

The information herein is provided for educational and informational purposes only and should not be construed as financial, legal, or investment advice. The views expressed represent Seneca’s current perspectives on the real estate development market as of the date of this material and are subject to change without notice. Past performance, market conditions, or trends do not guarantee and are not necessarily indicative of future results. The views expressed represent Seneca’s current perspectives on the real estate development market as of the date of this material and are subject to change without notice. Past performance, market conditions, or trends do not guarantee and are not necessarily indicative of future results.